Naive Forecasts¶

In some sense, time series forecasting is easy, if we have low expectations. From a dynamical system point of view, our future is usually not too different from our current state.

Last Observation¶

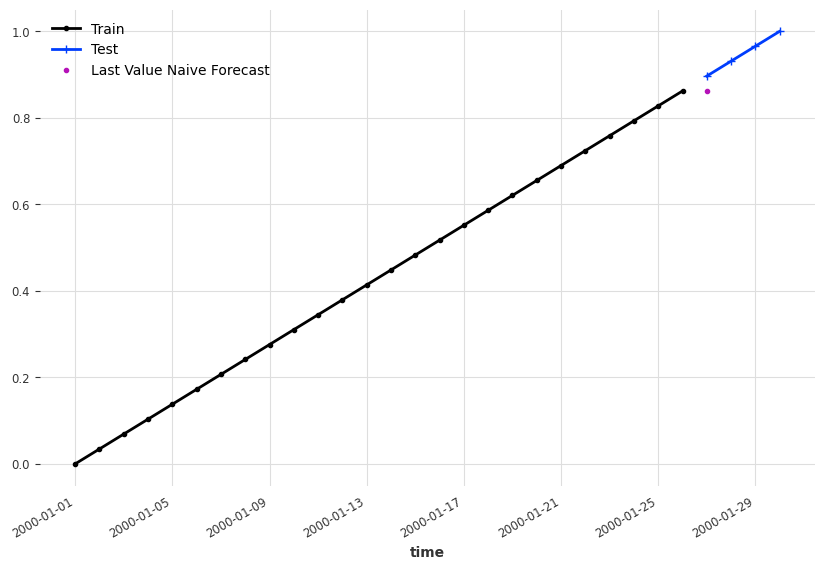

Assuming our time series is not changing dramatically, we can take our last observation as our forecast.

Example: Last Observation as Forecast

Assuming we have the simplest dynamical system,

where \(y(t)\) is the time series generator function, \(t\) is time, \(\theta\) is some parameters defining the function \(f\).

For example,

is a linear growing time series.

We would imagine, it won't be too crazy if we just take the last observed value as our forecast.

import matplotlib.pyplot as plt

from darts.utils.timeseries_generation import linear_timeseries

ts = linear_timeseries(length=30)

ts.plot(marker=".")

ts_train, ts_test = ts.split_before(0.9)

ts_train.plot(marker=".", label="Train")

ts_test.plot(marker="+", label="Test")

ts_last_value_naive_forecast = ts_train.shift(1)[-1]

fig, ax = plt.subplots(figsize=(10, 6.18))

ts_train.plot(marker=".", label="Train", ax=ax)

ts_test.plot(marker="+", label="Test", ax=ax)

ts_last_value_naive_forecast.plot(marker=".", label="Last Value Naive Forecast")

There are also slightly more complicated naive forecasting methods.

Mean Forecast¶

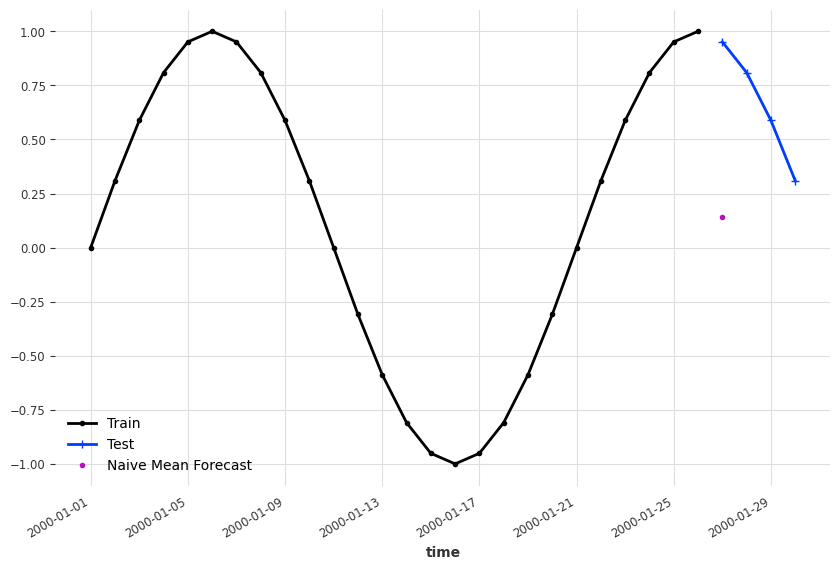

In some bounded time series, the mean of the past values is also a good naive candidate1.

Example: Naive Mean Forecast

import matplotlib.pyplot as plt

from darts.utils.timeseries_generation import sine_timeseries

from darts.models.forecasting.baselines import NaiveMean

ts_sin = sine_timeseries(length=30, value_frequency=0.05)

ts_sin.plot(marker=".")

ts_sin_train, ts_sin_test = ts_sin.split_before(0.9)

ts_sin_train.plot(marker=".", label="Train")

ts_sin_test.plot(marker="+", label="Test")

naive_mean_model = NaiveMean()

naive_mean_model.fit(ts_sin_train)

ts_mean_naive_forecast = naive_mean_model.predict(1)

fig, ax = plt.subplots(figsize=(10, 6.18))

ts_sin_train.plot(marker=".", label="Train", ax=ax)

ts_sin_test.plot(marker="+", label="Test", ax=ax)

ts_mean_naive_forecast.plot(marker=".", label="Naive Mean Forecast")

Simple Exponential Smoothing¶

Simple Exponential Smoothing (SES) is a naive smoothing method to account for the historical values of a time series when forecasting. The expanded form of SES is1

Truncated SES is Biased

Naively speaking, if history is constant, we have to forecast the same constant. For example, if we have \(y(t) = y(t_0)\), the smoothing

should equal to \(y(t_0)\), i.e.,

The series indeed sums up to \(1/\alpha\) when \(n\to\infty\) since

However, if we truncate the series to finite values, we will have

Then our naive forecast for constant series is

when \(y(t_0)\) is positive.

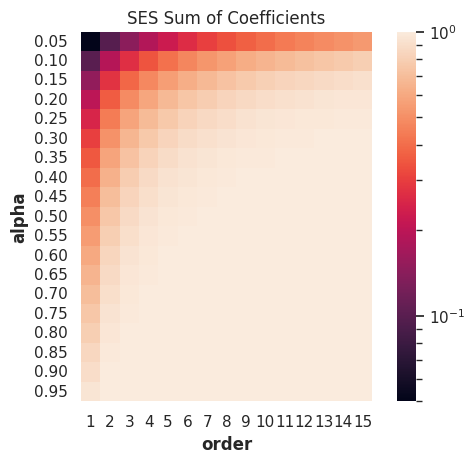

As an intuition, we plot out the sum of the coefficients for different orders and \(\alpha\)s.

from itertools import product

import pandas as pd

import seaborn as sns; sns.set()

from matplotlib.colors import LogNorm

def ses_coefficients(alpha, order):

return (

np.power(

np.ones(int(order)) * (1-alpha), np.arange((order))

) * alpha

)

alphas = np.linspace(0.05, 0.95, 19)

orders = list(range(1, 16))

# Create dataframes for visualizations

df_ses_coefficients = pd.DataFrame(

[[alpha, order] for alpha, order in product(alphas, orders)],

columns=["alpha", "order"]

)

df_ses_coefficients["ses_coefficients_sum"] = df_ses_coefficients.apply(

lambda x: ses_coefficients(x["alpha"], x["order"]).sum(), axis=1

)

# Visualization

g = sns.heatmap(

data=df_ses_coefficients.pivot(

"alpha", "order", "ses_coefficients_sum"

),

square=True, norm=LogNorm(),

fmt="0.2g",

yticklabels=[f"{i:0.2f}" for i in alphas],

)

g.set_title("SES Sum of Coefficients");

Holt-Winters' Exponential Smoothing

In applications, the Holt-Winters' exponential smoothing is more practical123.

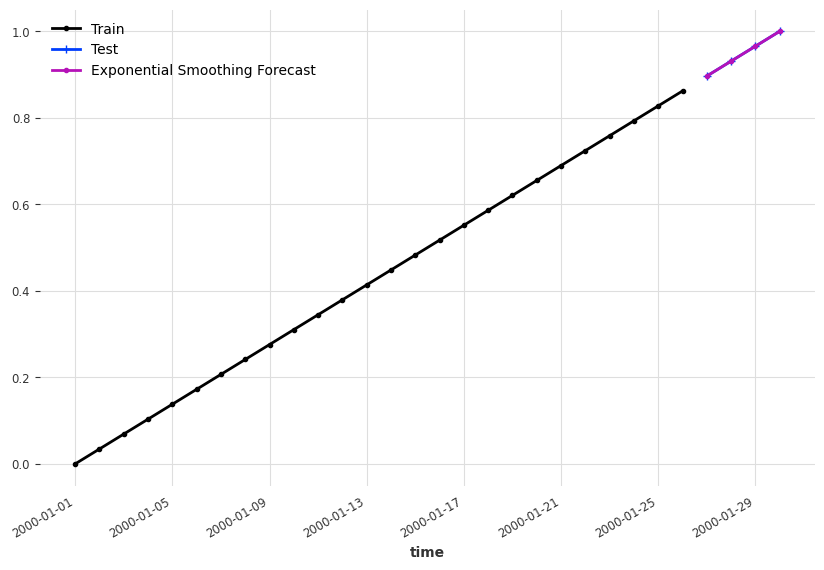

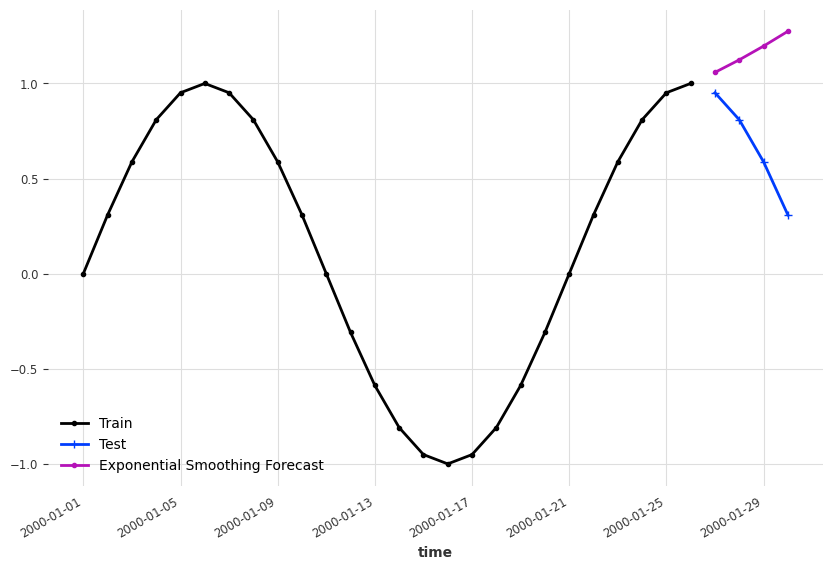

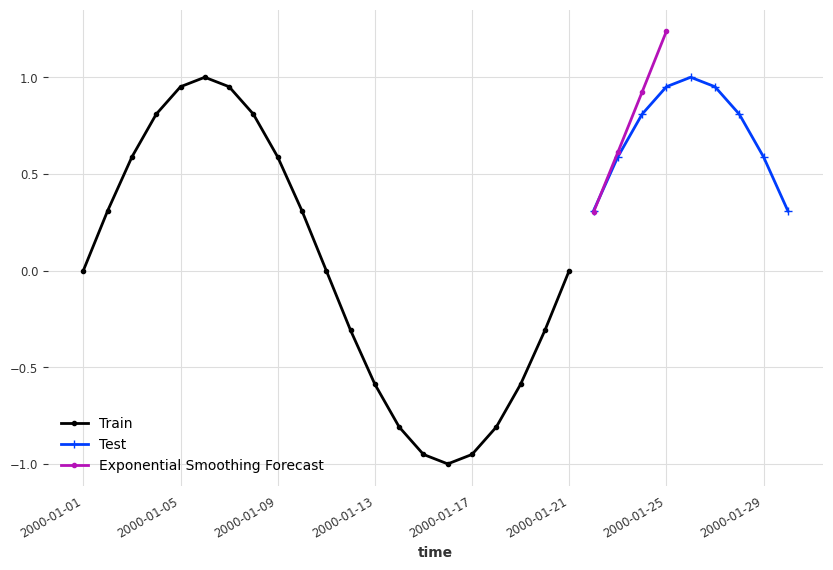

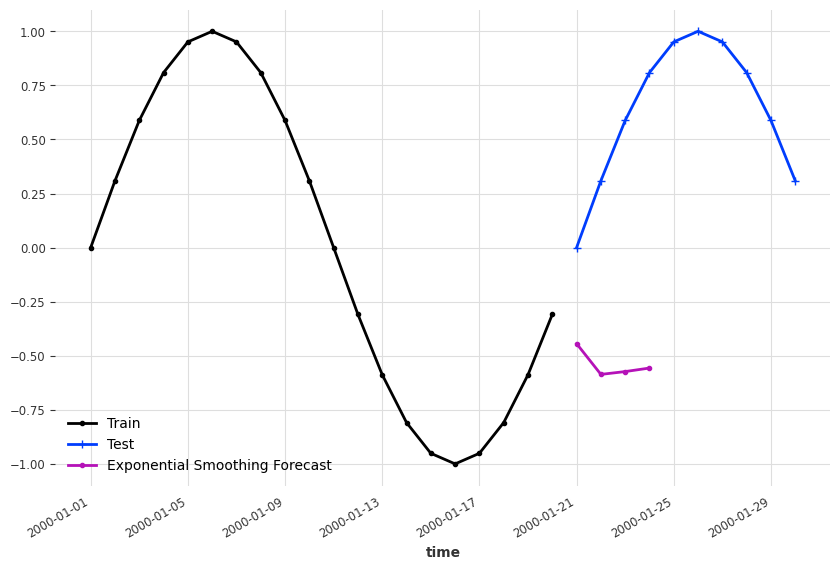

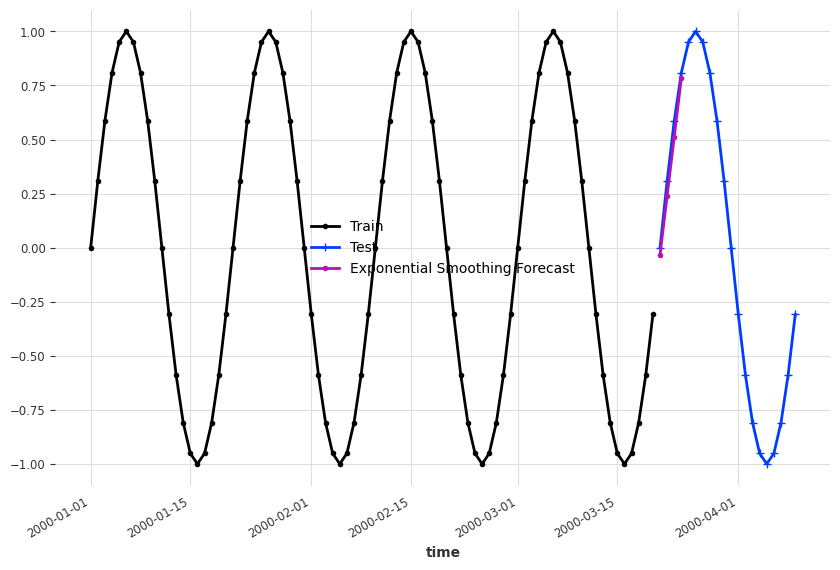

We created some demo time series and apply the Holt-Winters' exponential smoothing. To build see where exponential smoothing works, we forecast at different dates.

import matplotlib.pyplot as plt

from darts.utils.timeseries_generation import sine_timeseries

from darts.models.forecasting.baselines import NaiveMean

ts_sin = sine_timeseries(length=30, value_frequency=0.05)

ts_sin.plot(marker=".")

ts_sin_train, ts_sin_test = ts_sin.split_before(0.7)

es_model = ExponentialSmoothing()

es_model.fit(ts_sin_train)

es_model_sin_forecast = es_model.predict(4)

fig, ax = plt.subplots(figsize=(10, 6.18))

ts_sin_train.plot(marker=".", label="Train", ax=ax)

ts_sin_test.plot(marker="+", label="Test", ax=ax)

es_model_sin_forecast.plot(marker=".", label="Exponential Smoothing Forecast")

Other¶

Other naive forecasts, such as naive drift, are introduced in Hyndman, et al., (2021)1.

-

Hyndman, R.J., & Athanasopoulos, G. (2021) Forecasting: principles and practice, 3rd edition, OTexts: Melbourne, Australia. OTexts.com/fpp3. Accessed on 2023-02-13. ↩↩↩↩

-

6.4.3.5. Triple Exponential Smoothing. In: NIST Engineering Statistics Handbook [Internet]. [cited 16 Feb 2023]. Available: https://www.itl.nist.gov/div898/handbook/pmc/section4/pmc435.htm ↩

-

Example: Holt-Winters Exponential Smoothing — NumPyro documentation. In: NumPyro [Internet]. [cited 16 Feb 2023]. Available: https://num.pyro.ai/en/stable/examples/holt_winters.html ↩