VAR¶

VAR(1)¶

VAR(1) is similar to AR(1) but models time series with interactions between the series. For example, a two-dimensional VAR(1) model is

A more compact form is

Stability of VAR

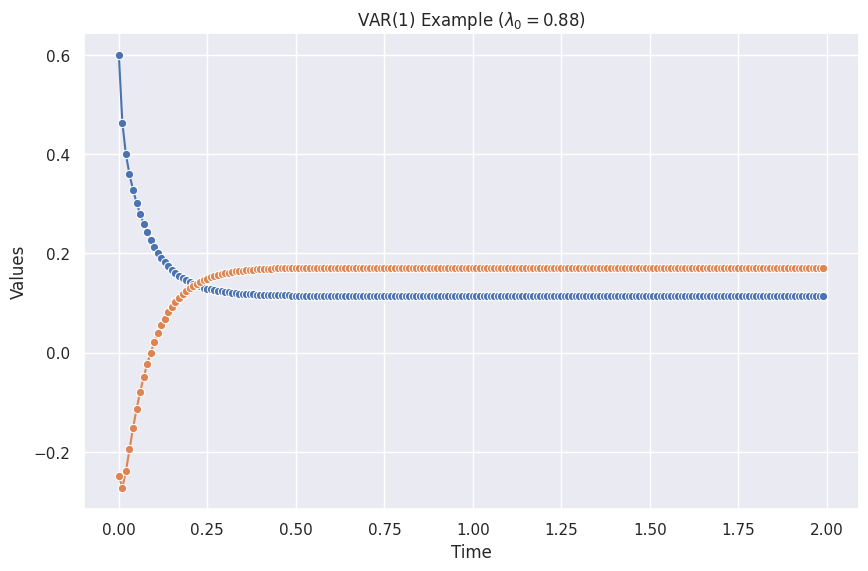

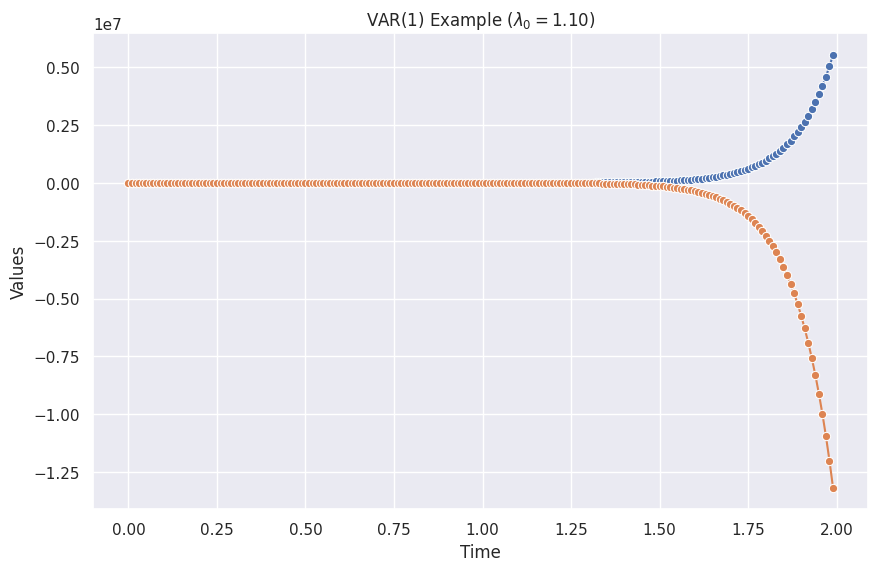

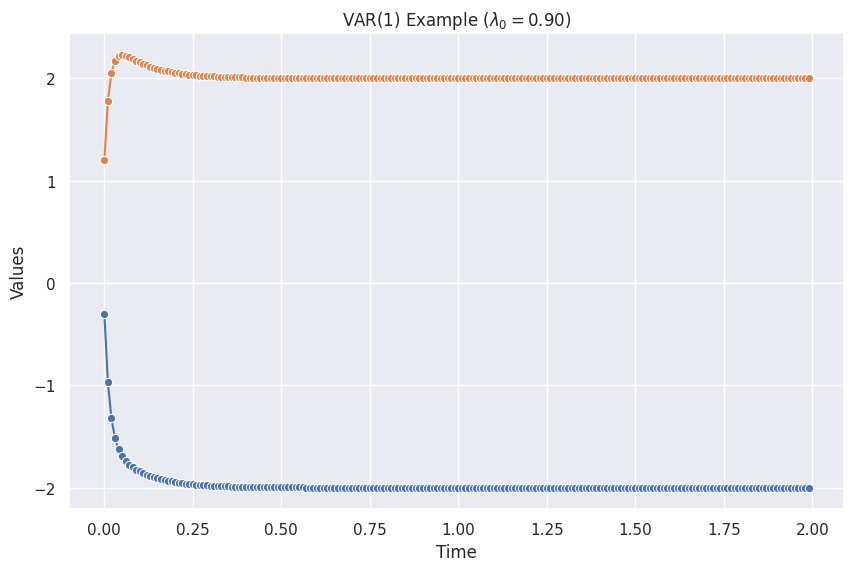

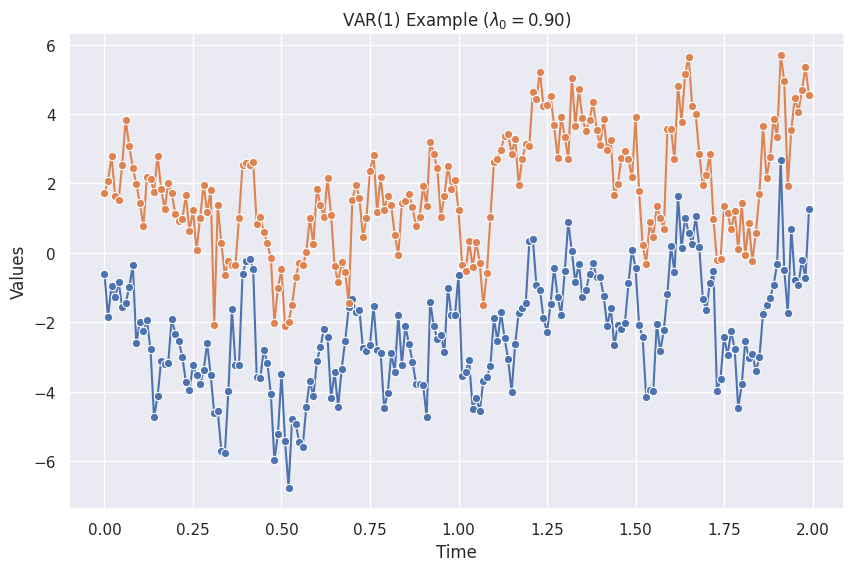

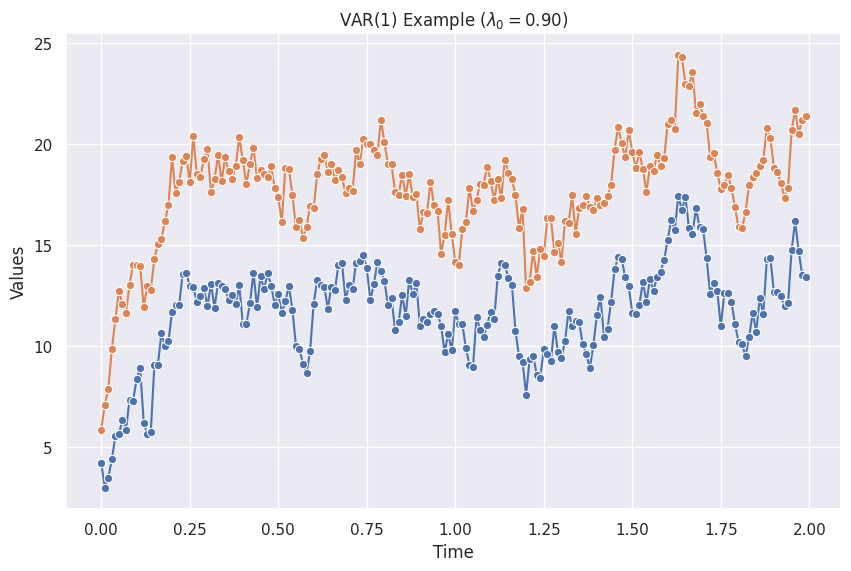

For VAR(1), our series blows up when the max eigenvalue of the matrix \(\boldsymbol \phi_1\) is large than 11. Otherwise, we get stable series.

In the following examples, we denote the largest eigenvalue of \(\boldsymbol \phi_1\) as \(\lambda_0\).

The figure is created using the code from the "Python Code" tab, and the following parameters.

var_params_stable = VAR1ModelParams(

delta_t = 0.01,

phi0 = np.array([0.1, 0.1]),

phi1 = np.array([

[0.5, -0.25],

[-0.35, 0.45+0.2]

]),

epsilon = ConstantEpsilon(epsilon=np.array([0,0])),

initial_state = np.array([1, 0])

)

var1_visualize(var_params=var_params_stable)

The figure is created using the code from the "Python Code" tab, and the following parameters.

var_params_unstable = VAR1ModelParams(

delta_t = 0.01,

phi0 = np.array([0.1, 0.1]),

phi1 = np.array([

[0.5, -0.25],

[-0.35, 0.45+0.5]

]),

epsilon = ConstantEpsilon(epsilon=np.array([0,0])),

initial_state = np.array([1, 0])

)

var1_visualize(var_params=var_params_unstable)

The figure is created using the code from the "Python Code" tab, and the following parameters.

var_params_no_noise = VAR1ModelParams(

delta_t = 0.01,

phi0 = np.array([-1, 1]),

phi1 = np.array([

[0.7, 0.2],

[0.2, 0.7]

]),

epsilon = ConstantEpsilon(epsilon=np.array([0,0])),

initial_state = np.array([1, 0])

)

var1_visualize(var_params=var_params_no_noise)

The figure is created using the code from the "Python Code" tab, and the following parameters.

var_params_zero_mean_noise = VAR1ModelParams(

delta_t = 0.01,

phi0 = np.array([-1, 1]),

phi1 = np.array([

[0.7, 0.2],

[0.2, 0.7]

]),

epsilon = MultiGaussianNoise(mu=np.array([0, 0]), cov=np.array([[1, 0.5],[0.5, 1]])),

initial_state = np.array([1, 0])

)

var1_visualize(var_params=var_params_zero_mean_noise)

The figure is created using the code from the "Python Code" tab, and the following parameters.

var_params_nonzero_mean_noise = VAR1ModelParams(

delta_t = 0.01,

phi0 = np.array([-1, 1]),

phi1 = np.array([

[0.7, 0.2],

[0.2, 0.7]

]),

epsilon = MultiGaussianNoise(mu=np.array([1, 2]), cov=np.array([[1, 0.5],[0.5, 1]])),

initial_state = np.array([1, 0])

)

var1_visualize(var_params=var_params_nonzero_mean_noise)

import copy

from dataclasses import dataclass

from typing import Iterator

import numpy as np

class MultiGaussianNoise:

"""A multivariate Gaussian noise

:param mu: means of the variables

:param cov: covariance of the variables

:param seed: seed of the random number generator for reproducibility

"""

def __init__(self, mu: np.ndarray, cov: np.ndarray, seed: Optional[float] = None):

self.mu = mu

self.cov = cov

self.rng = np.random.default_rng(seed=seed)

def __next__(self) -> np.ndarray:

return self.rng.multivariate_normal(self.mu, self.cov)

class ConstantEpsilon:

"""Constant noise

:param epsilon: the constant value to be returned

"""

def __init__(self, epsilon=0):

self.epsilon = epsilon

def __next__(self):

return self.epsilon

@dataclass(frozen=True)

class VAR1ModelParams:

"""Parameters of our VAR model,

:param delta_t: step size of time in each iteration

:param phi0: pho_0 in the AR model

:param phi1: pho_1 in the AR model

:param epsilon: noise iterator, e.g., Gaussian noise

:param initial_state: a dictionary of the initial state, e.g., `{"s": 1}`

"""

delta_t: float

phi0: np.ndarray

phi1: np.ndarray

epsilon: Iterator

initial_state: np.ndarray

class VAR1Stepper:

"""Calculate the next values using VAR(1) model.

:param model_params: the parameters of the VAR(1) model, e.g.,

[`VAR1ModelParams`][eerily.data.generators.var.VAR1ModelParams]

"""

def __init__(self, model_params):

self.model_params = model_params

self.current_state = copy.deepcopy(self.model_params.initial_state)

def __iter__(self):

return self

def __next__(self):

epsilon = next(self.model_params.epsilon)

phi0 = self.model_params.phi0

phi1 = self.model_params.phi1

self.current_state = phi0 + np.matmul(phi1, self.current_state) + epsilon

return copy.deepcopy(self.current_state)

class Factory:

"""A generator that creates the data points based on the stepper."""

def __init__(self):

pass

def __call__(self, stepper, length):

i = 0

while i < length:

yield next(stepper)

i += 1

We create a function to visualize the series.

def var1_visualize(var_params):

phi1_eig_max = max(np.linalg.eig(var_params.phi1)[0])

var1_stepper = VAR1Stepper(model_params=var_params)

length = 200

fact = Factory()

history = list(fact(var1_stepper, length=length))

df = pd.DataFrame(history, columns=["s1", "s2"])

print(df.head())

fig, ax = plt.subplots(figsize=(10, 6.18))

sns.lineplot(

x=np.linspace(0, length-1, length) * var_params.delta_t,

y=df.s1,

ax=ax,

marker="o",

)

sns.lineplot(

x=np.linspace(0, length-1, length) * var_params.delta_t,

y=df.s2,

ax=ax,

marker="o",

)

ax.set_title(f"VAR(1) Example ($\lambda_0={phi1_eig_max:0.2f}$)")

ax.set_xlabel("Time")

ax.set_ylabel("Values")

-

Zivot E, Wang J. Modeling Financial Time Series with S-PLUS®. Springer New York; 2006. doi:10.1007/978-0-387-32348-0 ↩